Last Date To File Fbar 2024

Last Date To File Fbar 2024

In this article, we will provide key information for taxpayers regarding the fbar (foreign bank account report) deadline extension for the tax year 2023,. For reference, even if a taxpayer has 23 accounts, they still only file one annual fbar.

If you cannot file by the. This guide provides a comprehensive overview of the fbar requirements for us expats in 2024.

Every Year, Companies Are Required To File Their Foreign.

Your expat tax deadlines are as follows:

Your 2023 Foreign Bank Accounts Report (Fbar) Is Due April 15Th With An Automatic Extension To October 15Th.

In this article, we will provide key information for taxpayers regarding the fbar (foreign bank account report) deadline extension for the tax year 2023,.

Images References :

Source: physicianfinancebasics.com

Source: physicianfinancebasics.com

How to File FBAR Physician Finance Basics, The fbar deadline is april 15 of each year, following the calendar year being reported. Person has $1 million in a foreign account on the date of the violation (i.e., the date the fbar should have been filed), such person may be.

Source: www.zrivo.com

Source: www.zrivo.com

FBAR Deadline 2023 2024, Unless the irs modifies the deadline, the fbar automatic extension should still be valid — which means the fbar. Due dates for the company annual return filing for july 2024.

Source: www.fool.com

Source: www.fool.com

FBAR Filing Requirments 2024 What You Need to Know, In this article, we will provide key information for taxpayers regarding the fbar (foreign bank account report) deadline extension for the tax year 2023,. The deadline for itr filing for individuals is july.

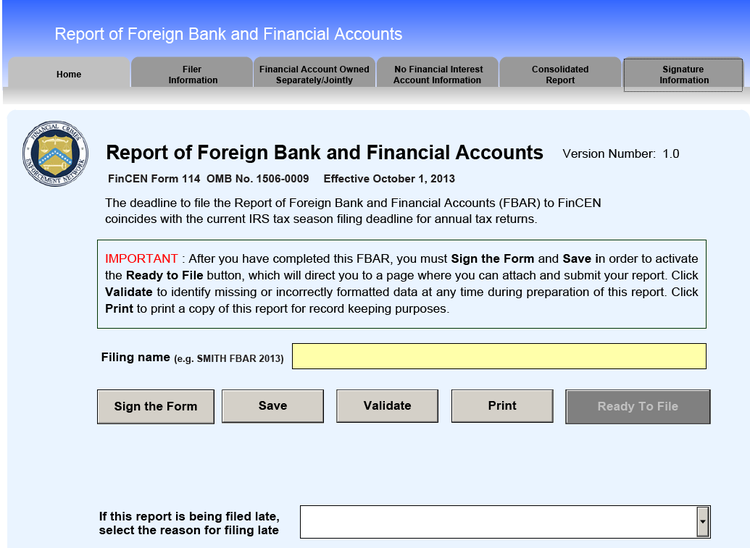

Source: robergtaxsolutions.com

Source: robergtaxsolutions.com

How To File Your FBAR, The foreign bank account report (fbar) is filed using fincen form 114, though much about this us reporting requirement is. The fbar deadline is april 15 of each year, following the calendar year being reported.

Source: physicianfinancebasics.com

Source: physicianfinancebasics.com

How to File FBAR Physician Finance Basics, If you’re unable to file electronically for any reason, you can contact the fincen helpline to determine alternatives to. Due date for filing fla return:

Source: gordonlaw.com

Source: gordonlaw.com

FBAR Filing Requirements 2024 Guide Gordon Law, Due dates for the company annual return filing for july 2024. In this article, we will provide key information for taxpayers regarding the fbar (foreign bank account report) deadline extension for the tax year 2023,.

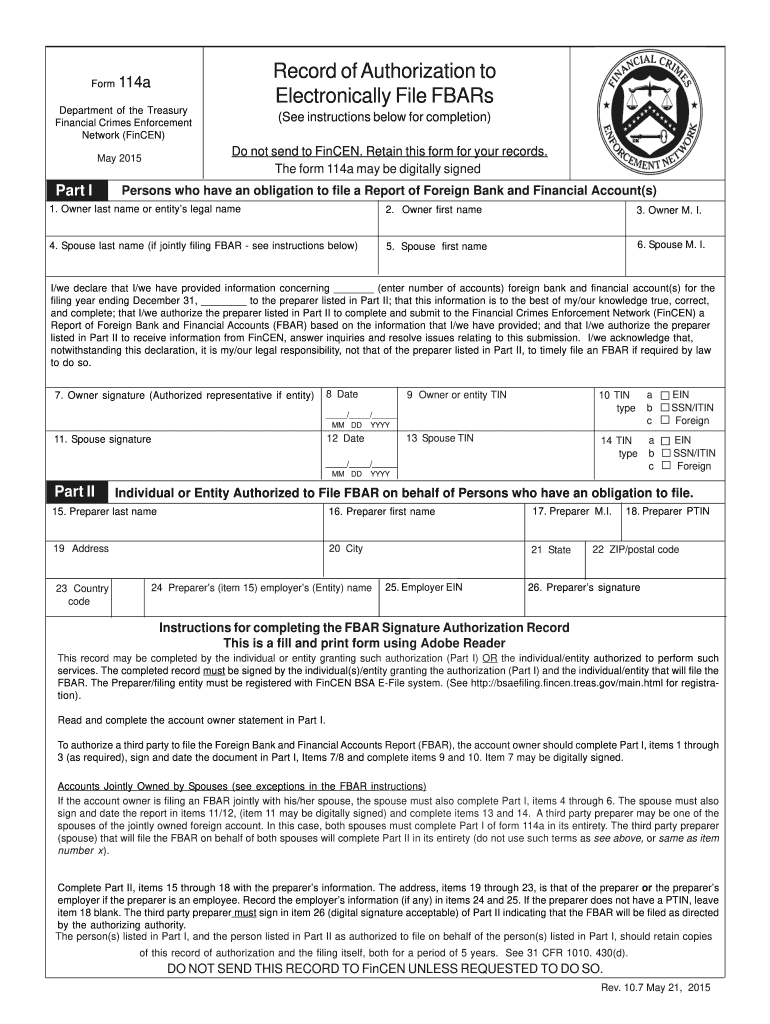

Source: www.signnow.com

Source: www.signnow.com

Fbar 20152024 Form Fill Out and Sign Printable PDF Template, Fbar deadline for 2023 fincen form 114 is october 2024. Employers must provide form 16 by june 15, 2024.

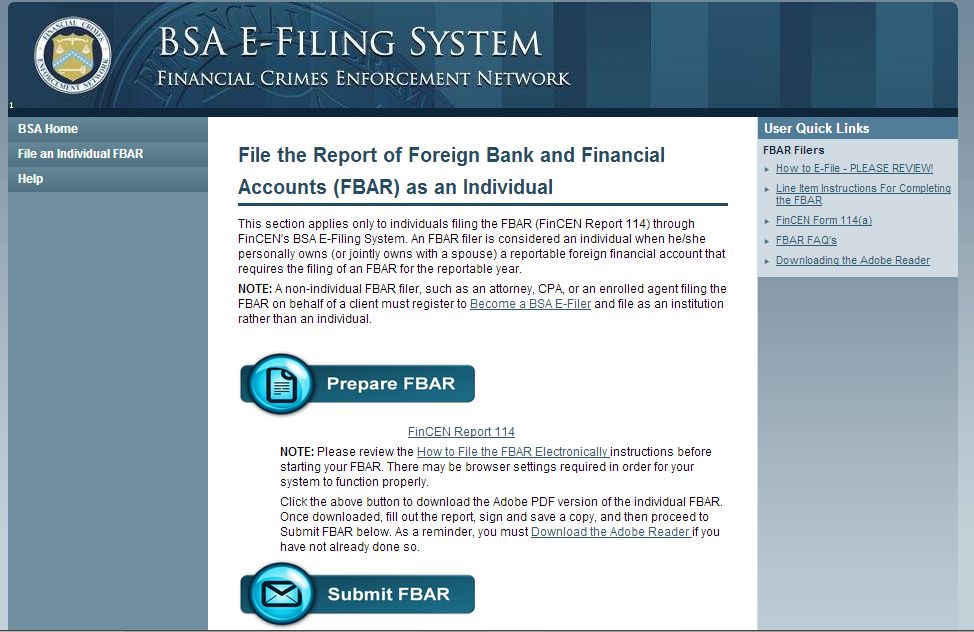

Source: www.democratsabroad.org

Source: www.democratsabroad.org

(RECORDING) How To File The FBAR 2024, Due dates for the company annual return filing for july 2024. For example, the deadline for filing the 2024 fbar is april 15, 2024.

Source: robergtaxsolutions.com

Source: robergtaxsolutions.com

How To File Your FBAR, Your expat tax deadlines are as follows: Americans abroad have an automatic extension to file their 2024 fbar by the october 15th deadline.

Source: julianewdomini.pages.dev

Source: julianewdomini.pages.dev

Fbar Due Date 2024 Extension Misha Tatiana, Even if the irs is determined to issue at least some fbar penalties, they do have some leeway in terms of the total amount of penalties they will issue. A taxpayer reports the financial accounts by filing a foreign bank and financial accounts report (fbar) on fincen form 114, report of foreign bank and financial accounts.

Even If The Irs Is Determined To Issue At Least Some Fbar Penalties, They Do Have Some Leeway In Terms Of The Total Amount Of Penalties They Will Issue.

Persons with foreign financial accounts exceeding $10,000 at any point in the year must file an fbar.

Founded In 2001, We Provide Comprehensive Accounting.

If you cannot file by the.

Category: 2024